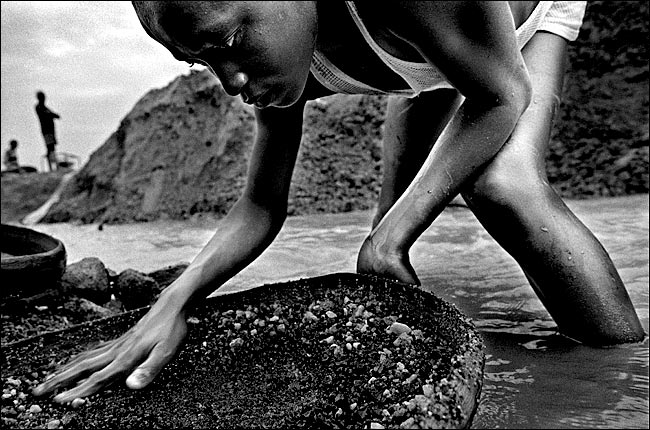

Conflict-free Diamonds

Keefirivunts is committed to combining beauty and responsibility by offering you only conflict-free diamonds. We understand how important it is to know the provenance of diamonds – this ensures that the gem you choose is not only visually beautiful, but also ethically pure.

What are Conflict-free Diamonds?

Conflict-free diamonds come from mines that do not fund armed conflicts or human rights abuses. Our company only works with trusted partners who follow the Kimberley Process requirements, ensuring that every diamond is traceable and conflict-free.

Kimberley Process

The Kimberley Process is an international initiative to prevent the trade in ‘blood diamonds’, or conflict diamonds. Blood diamonds are diamonds mined in conflict zones, with the proceeds of their sale used to fund armed conflicts and human rights abuses. The Kimberley Process was established in 2003. in response to growing concerns that the diamond trade contributes to violence, injustice and exploitation, particularly in African countries.

The process works through a certification system that ensures that trade in diamonds from member states is conflict-free. Each batch of diamonds must be accompanied by a Kimberley Process certificate, which confirms that diamonds have been extracted and traded in accordance with international ethical standards. The certificate contains information on the origin, weight, value and path of the diamonds, from the mine to the end user.

The Kimberley Process brings together governments, international organisations and the diamond industry. Its aim is not only to end the trade in conflict diamonds, but also to raise awareness of the importance of diamonds’ origin and promote responsible consumption.

Thanks to the Kimberley Process, the share of blood diamonds in the global market has been significantly reduced. According to the World Diamond Council, an estimated 99.8% of the world’s diamond supply is now conflict-free. Its success is due to the commitment of Member States to follow the process and to work together to promote ethical trade in diamonds.

Despite the achievements of the Kimberley Process, challenges remain. Critics point to the need to strengthen the transparency and accountability of the process, as well as to broaden its scope to include human rights abuses and environmental impacts of diamond mining. Work will therefore continue to make the diamond trade even more responsible and sustainable.

The value chain of themes

The value chain for diamonds becomes increasingly fragmented as you move downstream. Five mining companies produce most of the world’s raw supplies and the raw trade is concentrated in a few individual hubs around the world. Cutting and polishing, also known as manufacturing, is mainly done in Surat, India, where thousands of different companies operate. Gift shop retailing is even more fragmented, with family businesses accounting for the majority of outlets.

Natural diamonds are formed when carbon is applied under tremendous pressure and at high temperatures deep underground. The themes come from two types of deposits. Primary deposits usually consist of a volcanic rock called kimberlite in the form of “pipes”. These deposits were carried to the surface by magma. Secondary deposits, or alluvial deposits, are formed by the erosion of material from primary deposits and contain diamonds that have migrated some distance from their original source. Diamonds found deep underground are mined using open pit and underground methods. Subsurface excavation methods involve digging and screening materials such as silt, sand or gravel with shovels or (mechanical) sieves.

The world’s five largest mining companies produce around three quarters of the world’s total rough diamonds. South Africa’s De Beers and Russia’s Alrosa account for about 50% of world production. Other major mining companies include Rio Tinto in Australia, Dominion Diamond Mines in Canada and Petra Diamonds in the UK.

Diamonds have two main functions: jewellery and industrial use. Slightly more than 50 percent of the diamonds extracted are turned into gemstones, but they account for more than 95 percent of the total value. Nowadays, most diamonds used for industrial purposes are lab-grown diamonds. Once extracted, rough diamonds are separated into industrial-quality diamonds and gem-quality diamonds.

Gem-quality diamonds are either sold directly to diamond polishers, called Sight Holders, or auctioned off. London, Moscow and Antwerp are the main centres for buying and trading raw diamonds.

Turning rough stones into finished stones involves four steps: determining the optimum cut, splitting or sawing the rough diamond into pieces, bruting to give the diamond the desired shape and polishing the facets. Although cutting takes place in many countries around the world, about 90% of all diamonds by value are currently polished in India, mostly in the city of Surat.

After the stones are cut, they are often certified by independent laboratories, the best known of which is the Gemological Institute of America.

Polished diamonds are sold to jewellery manufacturers, jewellery shops or diamond dealers. Many jewellery shops, especially those selling engagement rings, buy polished diamonds directly, using their own or third-party ‘setters’ to place the diamonds into the jewellery they make. Antwerp, New York and Shanghai are important polished diamond sales centres and many large diamond companies maintain a presence in these cities. But recently, the point of sale has shifted closer to manufacturers in India, as many Indian suppliers have invested in their own sales and distribution channels.

Retail sales in the tea industry are dominated by private companies, often family-owned. Major players such as Tiffany & Co, Cartier, Signet and Chow Tai Fook account for around 30% of the industry. Most retailers are integrated at different stages of the value chain, from the sale of raw materials to the design and production of jewellery. Online jewellery sales account for around 5-10% of total jewellery sales, with diamond jewellery sales expected to be slightly higher. Online sales represent the fastest growing category in the industry.